Cities Most Dependent on Small Businesses

[ad_1]

Cities Most Dependent on Small Businesses

Small business is often held up as a key driver of the U.S. economy, and for good reasons.

According to the U.S. Small Business Administration, small businesses account for 64 percent of net private-sector jobs created since 2005. Collectively, small enterprises employ around 60 million Americans, which represents nearly half of the private workforce in the U.S. Compared to larger firms, small businesses tend to be nimbler, which promotes competition and innovation in the economy. Additionally, small businesses help strengthen communities, and entrepreneurship is a common route through which immigrants assimilate into the social and economic life of the U.S.

But with fewer financial resources than larger firms, small businesses are especially vulnerable during economic downturns. Where large firms can more easily turn to banks or capital markets for an infusion of funding in tough times, small enterprises are more likely to respond by scaling back operations, letting go of employees, or closing altogether.

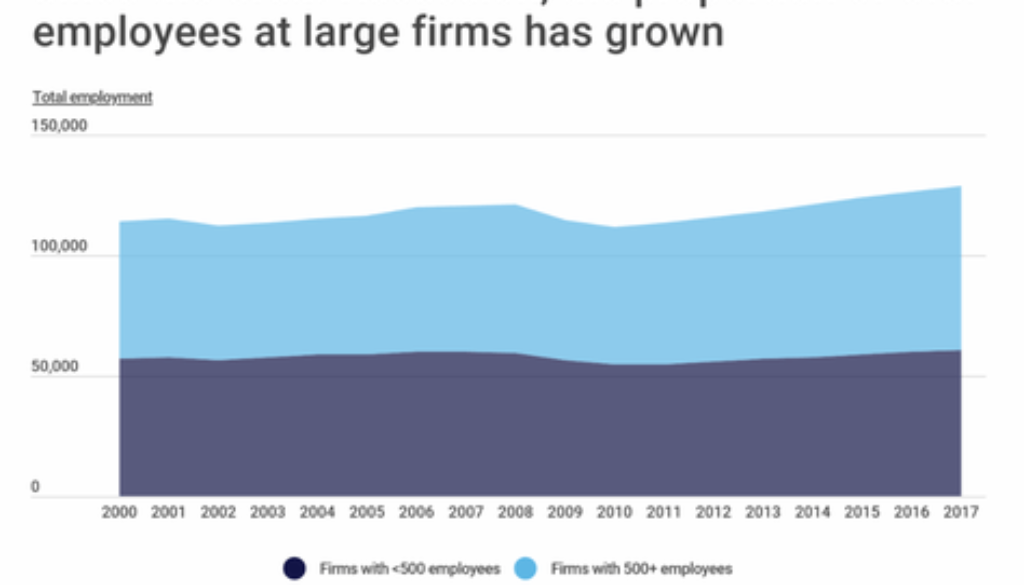

While the recession of 2008 and the slow recovery that followed were hard on all sectors of the economy, small businesses struggled even more than large firms. Thousands of small businesses failed in the wake of the recession. Many would-be small business owners decided not to take on the financial risk of starting a business during the weak economic recovery, and lenders proved more risk-averse in financing new businesses as well. As a result, industry concentration in large firms has increased over the last decade, and employment growth at large businesses has far outpaced that of small businesses over the same period.

Today, COVID-19 is creating more difficulties for small businesses. Some of the industry sectors that tend to be most densely populated with small firms have also been the sectors most affected by shifts in consumer behavior and government restrictions meant to slow the spread of the virus. Notably, accommodation, food services, and retail businesses together employ nearly a quarter of all small business employees. But with more people staying at home, these firms—many of which have already been forced to close—face dire circumstances.

The continued success of small business matters more for some locations than others. Rural states in the Upper Plains, like Wyoming and Montana, and in New England, like Vermont, have a much higher share of small business employees in the workforce than other states. Because these areas tend to have few large employers, failures in the small business sector could create job shortages and prolonged economic hardship in these areas.

At the metro level, some of the area’s most dependent on small businesses are in the aforementioned rural states, but other factors are at play as well. Some are Rust Belt communities where employment was formerly dominated by now-offshored manufacturing operations, leaving smaller businesses to generate most of the economic activity. Others have strong startup ecosystems that encourage entrepreneurs to create new firms.

To identify the locations most dependent on small businesses, researchers at Construction Coverage used U.S. Census data to find the percentage of employees in each metro employed at small businesses, defined as those firms having fewer than 500 employees.

Here are the large U.S. metropolitan areas most dependent on small businesses.

| Metro | Rank | Percentage of employees at small businesses | Total number of small business employees | Total number of small businesses | Percentage of total payroll paid by small businesses | Total small business payroll per employee | Total large-firm payroll per employee |

|---|---|---|---|---|---|---|---|

| New Orleans-Metairie, LA | 1 | 53.65% | 265,378 | 23,960 | 49.26% | $43,602 | $51,989 |

| Miami-Fort Lauderdale-West Palm Beach, FL | 2 | 53.50% | 1,184,791 | 167,326 | 48.27% | $43,392 | $53,498 |

| Oklahoma City, OK | 3 | 53.32% | 269,939 | 28,210 | 48.62% | $40,574 | $48,974 |

| Providence-Warwick, RI-MA | 4 | 52.36% | 333,667 | 33,162 | 47.72% | $43,098 | $51,898 |

| New York-Newark-Jersey City, NY-NJ-PA | 5 | 51.98% | 4,356,853 | 499,998 | 41.10% | $56,279 | $87,294 |

| Los Angeles-Long Beach-Anaheim, CA | 6 | 51.93% | 2,764,749 | 313,657 | 46.12% | $52,115 | $65,764 |

| Portland-Vancouver-Hillsboro, OR-WA | 7 | 51.41% | 538,511 | 55,667 | 41.79% | $45,280 | $66,725 |

| Buffalo-Cheektowaga-Niagara Falls, NY | 8 | 50.93% | 245,969 | 21,132 | 46.54% | $40,162 | $47,880 |

| Grand Rapids-Wyoming, MI | 9 | 50.36% | 253,133 | 19,092 | 48.50% | $43,895 | $47,283 |

| San Francisco-Oakland-Hayward, CA | 10 | 50.31% | 1,090,428 | 104,849 | 37.81% | $67,798 | $112,911 |

| San Diego-Carlsbad, CA | 11 | 50.06% | 634,069 | 69,216 | 42.59% | $49,023 | $66,233 |

| Washington-Arlington-Alexandria, DC-VA-MD-WV | 12 | 49.64% | 1,327,443 | 116,882 | 45.11% | $60,027 | $71,999 |

| Sacramento–Roseville–Arden-Arcade, CA | 13 | 49.45% | 367,438 | 38,300 | 41.78% | $45,280 | $61,702 |

| Austin-Round Rock, TX | 14 | 49.39% | 413,394 | 40,661 | 42.47% | $48,145 | $63,651 |

| Baltimore-Columbia-Towson, MD | 15 | 48.53% | 573,447 | 52,387 | 42.56% | $48,700 | $61,994 |

| United States | – | 47.09% | 60,556,081 | 5,976,761 | 40.32% | $44,777 | $58,996 |

For more information, a detailed methodology, and complete results, you can find the original report on Construction Coverage’s website: https://constructioncoverage.com/research/cities-most-dependent-on-small-businesses

The post Cities Most Dependent on Small Businesses appeared first on Global Trade Magazine.

[ad_2]

Source link

Discover more from My Business Web Space

Subscribe to get the latest posts sent to your email.

You must be logged in to post a comment.