Intuit Launches New Innovations to Help Consumers and Small Businesses with U.S. Government Aid and Relief Programs

[ad_1]

Intuit Launches New Innovations to Help Consumers and Small Businesses with U.S. Government Aid and Relief Programs

As the COVID-19 pandemic plays out around the world, the challenges facing consumers, small businesses, self-employed workers and accountants continues to grow. Many consumers and small businesses are struggling to make ends meet and provide for their families. They are facing a loss of income and a lack of savings to weather the storm. The recently passed U.S. government aid and relief programs are working to help get more money in the pockets of consumers and small businesses that need it most.

“The U.S. government has stepped in with much-needed relief and we’re partnering closely to help,” said Sasan Goodarzi, CEO of Intuit. “We applied our artificial intelligence and rapid innovation capabilities to help Americans navigate these offerings and get access to the money they need quickly.”

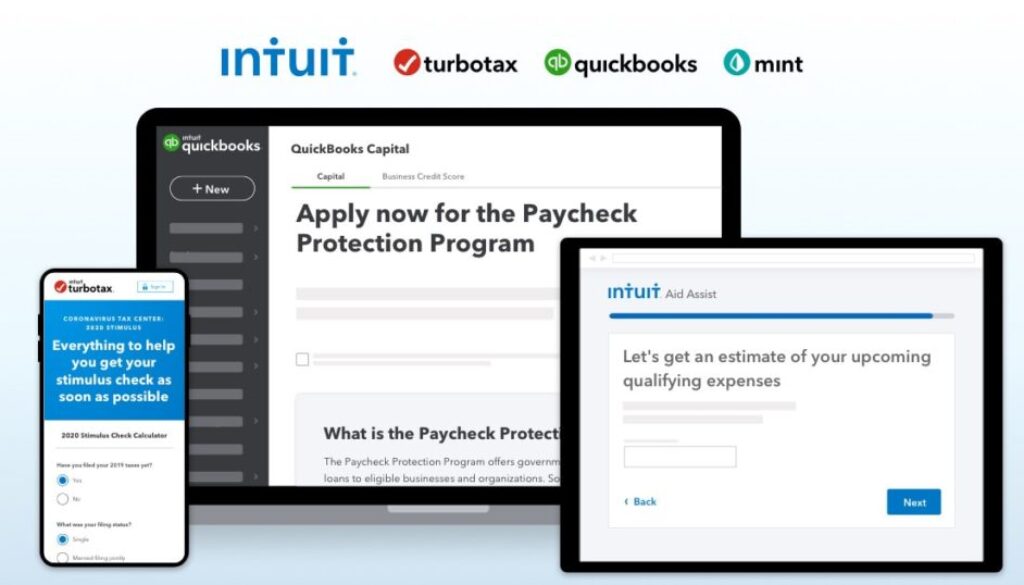

By partnering with the U.S. government and leveraging our platform capabilities, we’ve launched three new offerings – Intuit Aid Assist, QuickBooks Capital for Paycheck Protection Program, and TurboTax Stimulus Registration – to help consumers and small businesses better understand and potentially access billions of dollars through the recently passed federal aid and relief programs.

- Intuit Aid Assist – a free website with an interactive tool to help small business owners and the self-employed in the U.S. assess potential eligibility for financial relief under the CARES Act. Developed with Intuit’s artificial intelligence, Intuit Aid Assist leverages the same knowledge engineering technology used by TurboTax to simplify the tax code.

Intuit Aid Assist takes the complexity of hundreds of pages of the CARES Act and converts it into an easy-to-understand interview that provides answers to the most pressing questions on small business owners’ minds: What relief am I eligible for? How much of a loan can I get? How much of my loan may be forgiven so I don’t have to repay it?

The interactive tool assesses eligibility, estimates loan amounts, delivers a personalized recommendation and, for qualified small businesses and other eligible applicants, provides links to help them take the next step of applying for a loan. Intuit Aid Assist supports both the Paycheck Protection Program (PPP) and Economic Injury Disaster Loan (EIDL) relief programs.

- QuickBooks Capital – QuickBooks Capital is a non-bank SBA-approved lender for the Paycheck Protection Program (PPP). QuickBooks Capital will be able to simplify, automate and expedite the PPP application process. The product will assist applicants in determining eligibility and automating much of the application process, then facilitate the federal relief application process and, in coordination with the Small Business Administration, disburse PPP funds, allowing quick access to relief. QuickBooks Capital will be able to begin processing PPP loan applications soon.

- TurboTax Stimulus Registration – a free product designed to help the more than 10 million Americans not required to file a tax return get their stimulus money fast. On April 3rd, TurboTax launched the Stimulus Registration product to help millions easily file a minimum tax return with the IRS, which has the information needed to determine their stimulus eligibility. Users simply answer a few questions and then choose to receive their payment via direct deposit or check.

With less than two weeks in the market, the TurboTax Stimulus Registration product has helped more than 165,000 Americans register for over $230 million dollars of federal stimulus money.

In addition to being part of the effort that’s helping millions of Americans access hundreds of billions of dollars that are available in government aid and relief programs, Intuit is also investing in other initiatives to support consumers, small businesses and the self-employed with the potential to generate hundreds of millions of dollars in value:

Across these initiatives, we believe we can put a meaningful dent in the unforeseen challenges our customers now face. There is no perfect solution for this unprecedented situation. But we know we can’t face this alone, which is why we are working together to ensure we have the greatest impact on those who need it most.

[ad_2]

Source link

Discover more from My Business Web Space

Subscribe to get the latest posts sent to your email.