Organize your finances with Money in Excel

Organize your finances with Money in Excel

Get your finances in order with help from Money in Excel. See your accounts in one place, plus things like how much you spent online shopping last week and alerts about recurring payments, bank fees, overdraft warnings, and more.

Money in Excel can help you improve your spending habits by providing personalized insights into your monthly spending and proactive alerts about price changes for recurring payments, bank fees, overdraft warnings, and more.

Money in Excel gives you the tools to help you achieve your financial goals.

Find out more about Microsoft 365 Family subscription

Managing personal finances can be a daunting prospect for most people, but having the right tools can help make it less challenging. While millions of people use Excel to track their budgets, manually updating a budget spreadsheet every month with the latest transactions can be a very time-consuming process. As organizing and tracking finances becomes a critical task for many of us, we want to help make managing your personal budget in Excel a more seamless experience.

Manage your money—without ever leaving Excel

Money in Excel is a dynamic, smart template and add-in for Excel that allows you to securely connect your bank, credit card, investment, and loan accounts to Excel and automatically import your transaction and account information into an Excel spreadsheet.

If you’re a current Microsoft 365 Personal or Family subscriber, simply go to this link to download the template. Once downloaded, open the Excel template1 and follow the on-screen prompts to connect your financial accounts using a secure third-party plugin supported by Plaid2 (Plaid currently supports most major U.S. financial institutions). Once your account information is verified, the workbook will be updated with your latest transaction history3 and is now ready for use.

Now, let’s look at how Money in Excel can help simplify the task of managing your finances.

Keep track of your money

Once your financial accounts3 are connected, Money in Excel will automatically import your transaction information from all your accounts into one workbook.

You no longer need to spend hours manually setting up a personal finance spreadsheet from scratch; Money in Excel does it for you in just a few seconds. And every time you want to update the workbook with the latest transactions, just click the Update button and get the latest snapshot of your transactions and accounts without ever leaving Excel.

Get closer to your financial goals

Once your transaction information is imported into Excel, it’s easy to track your spending habits to help you stay on course and get closer to your financial goals.

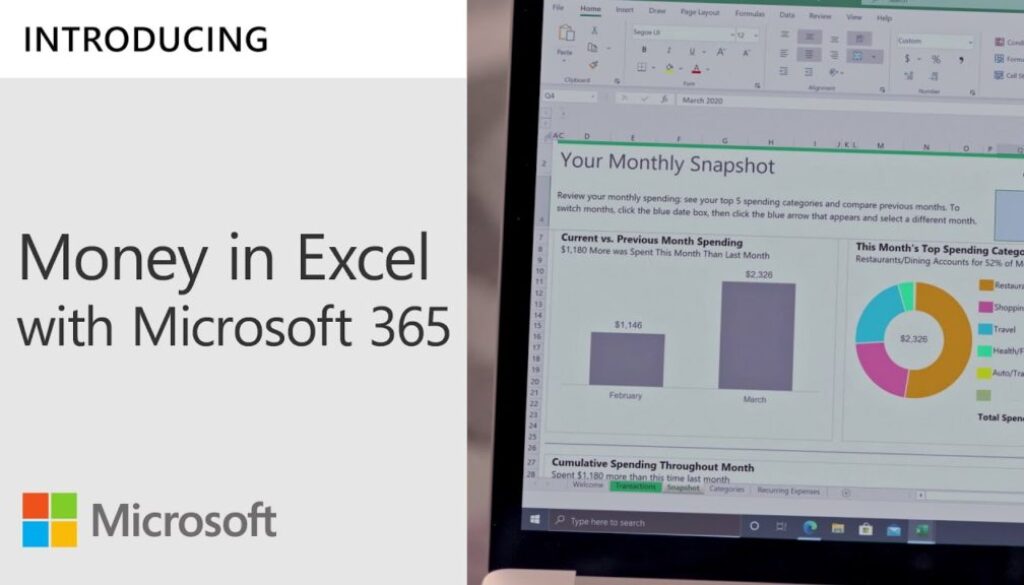

Use the “Snapshot” sheet to get an instant glimpse of how you’re spending across various categories such as groceries, household items, rent, and more. With the help of easy-to-read graphs, you can quickly track how your spending compares month over month. And to help ensure you are not caught unaware of any unwelcome transactions, Money in Excel will alert you to increases in your subscription fees, changes in bank and overdraft charges, or any big purchases that were posted during the month.

Easily customizable to suit your needs

We know people often choose Excel to manage their finances because it allows them to take a more personalized approach. With this in mind, we designed Money in Excel to be easily customizable to suit your needs and goals. For example, if a certain transaction does not fall within an existing spending category, you can simply add your own. If you want to perform a quick custom analysis, you can copy the relevant transactions into a new Excel sheet and use any of your favorite Excel features to do quick calculations. And while Money in Excel already comes with charts that have been created based on your transaction information—such as one for your recurring expenses—you can always create your own charts and tables and add them to the workbook.

From helping you track your monthly spending to alerting you about subscription price increases, Money in Excel makes it easy to manage your money. We hope that by using Money in Excel, organizing your finances becomes a more manageable and empowering experience. We can’t wait for you to try it out and share your feedback with us.

1For the best experience, we recommend using Money in Excel on a PC or Mac. Optimal performance when using Windows 10 and Edge/Chrome browsers.

2Plaid is a third-party company that provides permissioned connections to financial accounts, at the user’s direction, to power Money in Excel.

3After granting permission for Plaid to connect a financial account with Money in Excel, Plaid will access the account’s balances, transaction history, and associated account information, like owner name and address. Plaid will not have access to your Microsoft 365 subscription login information and will not share financial institution login credentials with Microsoft. Contact Plaid at [email protected] or by clicking the support button at https://my.plaid.com/help to learn about options for managing your data with Plaid.

4For any additional information regarding Money in Excel, visit our FAQ.

Want to learn more about Money in Excel? Money in Excel resources: https://msft.it/6004TlRL4 Money in Exel FAQ guide: https://msft.it/6006TlR28

Discover more from My Business Web Space

Subscribe to get the latest posts sent to your email.