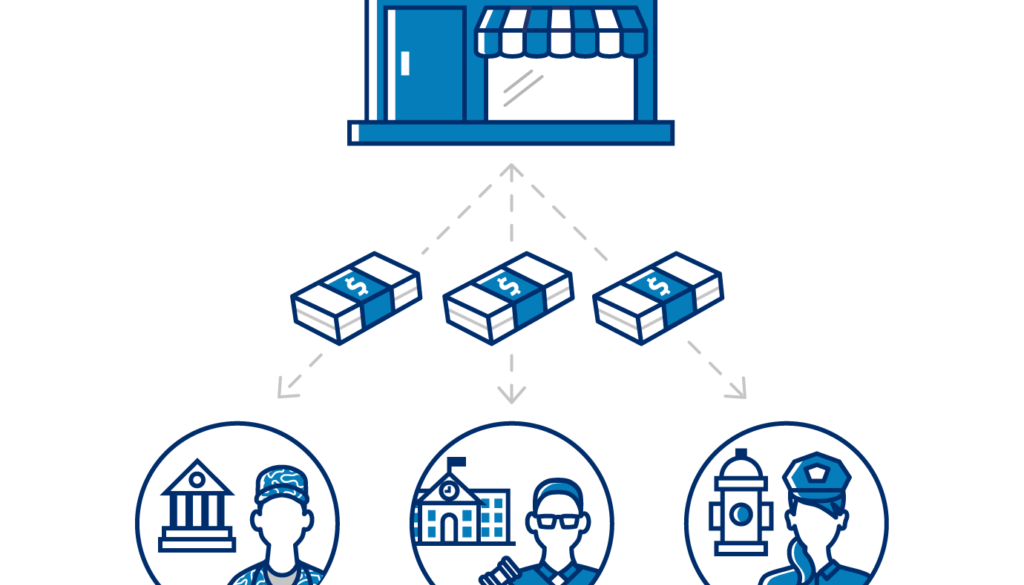

Pay taxes

Pay taxes…Your business will need to meet its federal, state, and local tax obligations to stay in good legal standing. Your business structure and location will influence which taxes your business has to pay.

Need help filing your taxes?

Click here to Book an online appointment

Choose your tax year

Your business is legally required to pay taxes and keep accounting records on a consistent yearly schedule called a tax year.

Most businesses choose their tax year to be the same as the calendar year. You select your tax year the first time you file for taxes, but can change it later with permission from the IRS.

- Calendar tax year if you don’t have special accounting needs for your business.

- Fiscal tax year if you want your 12-month accounting cycle to end in a month that isn’t December.

- Short tax year if your business wasn’t in existence for an entire tax year, or you changed your accounting period.

If your business doesn’t have much reporting or bookkeeping, you might be required to use a calendar tax year. Check with the IRS for detailed rules about tax years.

Determine your state tax obligations

Your business might need to pay state and local taxes. Tax laws vary by location and business structure, so you’ll need to check with state and local governments to know your business’ tax obligations.

The two most common types of state and local tax requirements for small business are income taxes and employment taxes.

Your state income tax obligations are determined by your business structure. For example, corporations are taxed separately from the owners, while sole proprietors report their personal and business income taxes using the same form.

If your business has employees, you’ll be responsible for paying state employment taxes. These vary by state, but often include workers’ compensation insurance, unemployment insurance taxes, and temporary disability insurance. You might also be responsible for withholding employee income tax. Check with your state tax authority to find out how much you need to withhold and when you need to send it to the state.

Determine your federal tax obligations

Your business structure determines what federal taxes you must pay and how you pay them. Some of the taxes require payment throughout the year, so it’s important to know your tax obligations before the end of your tax year.

There are five general types of business taxes.

- Income tax

- Self-employment tax

- Estimated tax

- Employer tax

- Excise tax

Each category of business tax might have special rules, qualifications, or IRS forms you need to file. Check with the IRS to see which business taxes apply to you.

If your business has employees, you might be required to withhold taxes from their paychecks. Federal employment taxes include income, Social Security and Medicare, unemployment, and self-employment taxes. Check with the IRS to see which taxes you need to withhold.

Need help filing your taxes?

Click here to Book an online appointment

Discover more from My Business Web Space

Subscribe to get the latest posts sent to your email.