This new IRS tool offers a new way to estimate next year’s tax refund

This new IRS tool offers a new way to estimate next year’s tax refund. Have you done anything to withhold more money out of your paycheck to cover that 2019 tax bill?

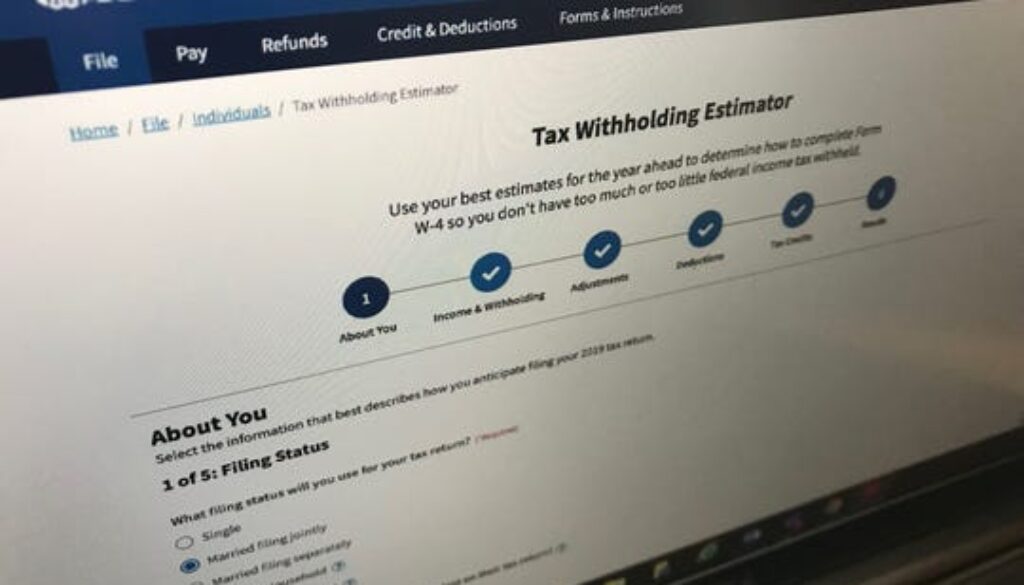

The IRS has launched a new Tax Withholding Estimator. The calculator makes it easier to enter wages and withholding for each job held by the taxpayer and their spouse, as well as separately entering pensions and other sources of income.

Fine tuning how much money you’re withholding in taxes now can make a giant difference between fearing having to write a big check to pay taxes in April or looking forward to getting a tax refund.

The estimator, which replaces the old IRS online tax withholding calculator, should help you see how on track you are right now. If necessary, you could adjust and dedicate more or less money toward federal income taxes out of your paycheck, and your spouse’s paycheck, too.

- Product on sale

Microsoft Surface Pro 2-in-1 Laptop/Tablet (2024), Windows 11 Copilot+ PC, 13″ Touchscreen Display, Snapdragon X Plus (10 Core), 16GB RAM, 512GB Storage, DuneOriginal price was: $1,199.99.$899.99Current price is: $899.99.

Microsoft Surface Pro 2-in-1 Laptop/Tablet (2024), Windows 11 Copilot+ PC, 13″ Touchscreen Display, Snapdragon X Plus (10 Core), 16GB RAM, 512GB Storage, DuneOriginal price was: $1,199.99.$899.99Current price is: $899.99.  Beneficial Ownership Information Report Filing Service$250.00

Beneficial Ownership Information Report Filing Service$250.00 A Landlord’s Guide to Success$9.99

A Landlord’s Guide to Success$9.99 Launching Your Political Campaign Consulting Business$9.99

Launching Your Political Campaign Consulting Business$9.99 Unlock the World of Cryptocurrency: Your Comprehensive Guide$9.99

Unlock the World of Cryptocurrency: Your Comprehensive Guide$9.99 Ghostwriting Gold: A Comprehensive Guide to Starting Your Own Ghostwriting Business$9.99

Ghostwriting Gold: A Comprehensive Guide to Starting Your Own Ghostwriting Business$9.99 Starting a Successful Retail Clothing Business: A Step-by-Step Guide$9.99

Starting a Successful Retail Clothing Business: A Step-by-Step Guide$9.99 Starting Your Film Production Business: A Step-by-Step Guide E-Book$9.99

Starting Your Film Production Business: A Step-by-Step Guide E-Book$9.99 Sales Letter Template: A Mutual Friend Suggested I Contact You$0.99

Sales Letter Template: A Mutual Friend Suggested I Contact You$0.99

Getting your withholding right takes on greater importance after a rather unsettling tax season earlier this year when many taxpayers ended up paying more than expected or took home far smaller tax refunds than usual.

For some tax filers, though, the extra money that ended up in their paychecks turned out to be even more than the amount their taxes would have gone down under the Tax Cuts and Jobs Act.

Were you disappointed by a smaller tax refund?

Under the new tax rules, some people lost key tax benefits. Maybe your children are 17 or older and you don’t get as big of a tax break. Maybe you now can only deduct up to $10,000 — and no more — for the money paid for state income taxes, local taxes and property taxes.

The online tool gives you step-by-step instructions for how to fill out a W-4. And you’re easily able to download a blank W-4 to give to your employer.

Discover more from My Business Web Space

Subscribe to get the latest posts sent to your email.