How to create and file 1099s in QuickBooks Online

How to create and file 1099s in QuickBooks Online

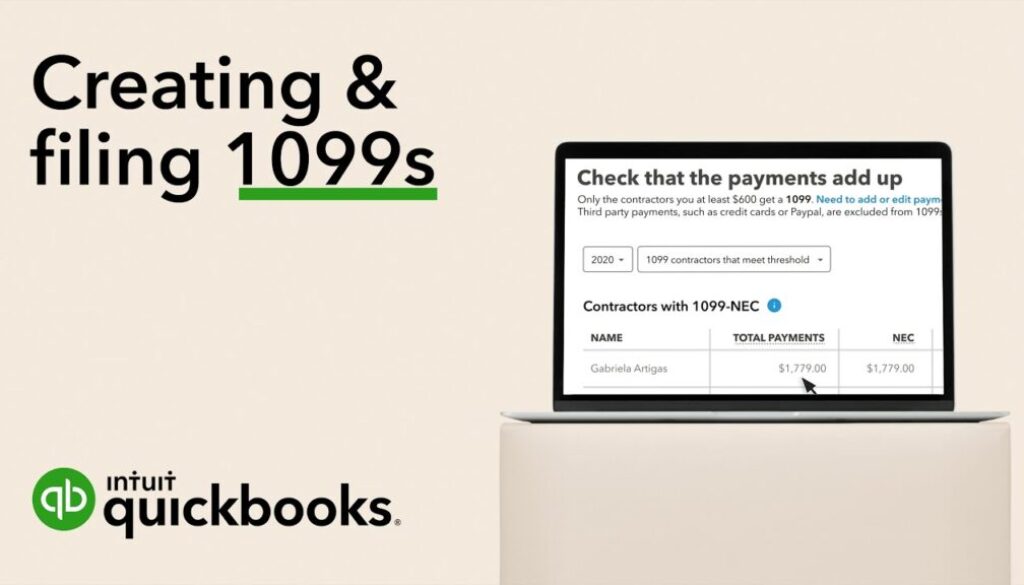

You can create 1099s in QuickBooks Online to send to your contractors and e-file with the IRS.

Let’s go over how to prepare your 1099s and where you can e-file them with QuickBooks Online after January 1st.

Here’s some important notes about 1099s:

– QuickBooks Online supports both the 1099-NEC and 1099-MISC forms.

– 1099s are due to contractors by January 31.

– The 1099-NEC is due to the IRS by January 31.

– The 1099-MISC is due to the IRS by February 28 if you file on paper, or by March 31 if you file electronically.

– QuickBooks Online only supports federal 1099 filing. You may also be required to file them with your state. Contact your state agency for requirements to prepare and file 1099s with them.

Discover more from My Business Web Space

Subscribe to get the latest posts sent to your email.