WTFinance is Cyberbullying Insurance? – MintLife Blog

[ad_1]

WTFinance is Cyberbullying Insurance? – MintLife Blog

When most people think about cyberbullying – or any form of bullying – they tend to think about children and adolescents. But adult cyberbullying is very real, and it can have very real financial consequences.

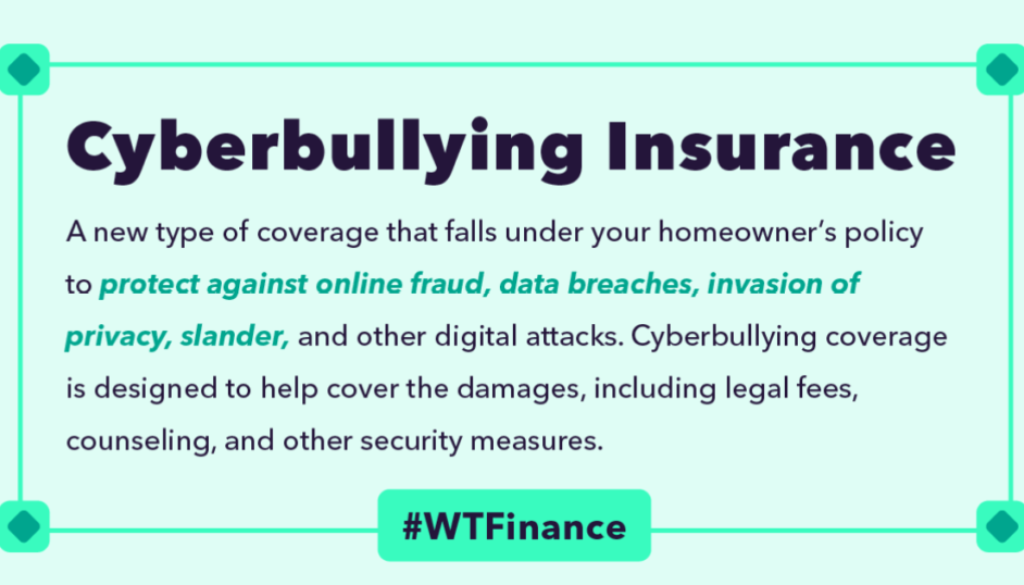

That’s why cyberbullying insurance exists. Let’s look at this niche insurance sub-category to get a better sense of when it might be useful.

What is Cyberbullying Insurance?

Each insurance company is different, but many cyberbullying insurance policies cover legal, mental health and public relations expenses associated with cyberbullying. If you suffer depression or anxiety because of cyberbullying, cyberbullying insurance may pay for visits to a counselor or psychiatrist. If you are falsely accused of cyberbullying, this insurance can pay for specialists to try and fix your online reputation.

“Although most insurance policies cover tangible assets, cyberbullying insurance covers more ill-defined dangers, such as deleted online data, tarnished reputations, and emotional consequences resulting from harassment,” said attorney Lyle David Solomon.

The monthly premium for a cyberbullying policy depends on how much coverage you’re buying and what the insurance company will cover. You can buy cyberbullying insurance as a separate insurance policy or as an add-on to your existing homeowners insurance.

Because this is such a new type of insurance, it’s harder to find cyberbullying policies. For now, start-up companies like Chubb or established insurance companies like Nationwide sell cyberbullying insurance.

Do You Need Cyberbullying Insurance?

If you’re a public figure, have a large social media following, or have a public-facing job, cyberbullying insurance may give you some peace of mind. But before you spring for a policy, make sure you understand what it includes.

For example, some insurance companies sell cyber protection policies. These may only offer extended fraud protection or extra assistance with identity theft. They don’t specifically cover the expenses associated with cyberbullying.

Also, you generally need to prove that any financial expenses you incur are related to cyberbullying.

“For example, if an individual loses his employment due to cyberbullying, this coverage can help him by reimbursing the lost wages up to the policy limits,” Solomon said.

In some cases, you may need to pay for cyberbullying-related expenses out of pocket before having them reimbursed by the insurance provider. Make sure your existing insurance coverage doesn’t already cover some of the costs that you may incur. For example, if you already have health insurance, that may cover mental health expenses like therapy or anti-anxiety medication.

You should also look at the deductible, which is the amount you must pay before insurance kicks in. Read the terms and conditions to see which costs are covered and which aren’t.

Related

Sign up for Mint today

From budgets and bills to free credit score and more, you’ll

discover the effortless way to stay on top of it all.

Zina Kumok (152 Posts)

Zina Kumok is a freelance writer specializing in personal finance. A former reporter, she has covered murder trials, the Final Four and everything in between. She has been featured in Lifehacker, DailyWorth and Time. Read about how she paid off $28,000 worth of student loans in three years at Conscious Coins.

Links

[ad_2]

Source link

Discover more from My Business Web Space

Subscribe to get the latest posts to your email.

You must be logged in to post a comment.